Road to Riches: Vol. I

If I’m being honest—I don’t like the word financial. Silly right?

When I read the word “financial”, it conveys far more treacherous meaning than, “related to finance” or “related to the management of money”.

For me, this word carries woeful connotations attributed to having graduated college during the Global Financial Crisis of 2007-2008.

When I think—financial—I instantly marry it with other words such as financial: ruin, despair, setbacks, hardships, turmoil, and so on and so forth.

All of these sound like a match made in hell. 😈

Two primary reasons are why this happens:

- I had a rocky start with my own finances after college.

- I’ve been conditioned to form negative associations with this word.

As of writing this, typing the word financial into Google and clicking the News tab returns these results:

“Financial Problems Bigger Than Personal Issues”

“Former NSA Chief Warns of Russian Cyberattacks against US Financial Sector”

“Europe faces ‘severe’ risk of disorderly financial market correction”

“Past financial crisis have made millennials ‘more cautious, more proactive’ in how they manage money ” (that’s for darn sure).

In my opinion, this word stinks, and as much as I’ll reluctantly use it, I didn’t in the title of this blog post which should have been: “The Basics of Financial Planning” or something dull to that effect.

Instead, I decided to call this article, “Intro to Money Mastery”, because at least for me, the word “money” elicits feelings of happiness—I mean who doesn’t like money? 😊

Speaking of the post title, I assume you’re working and making your own money.

Good.

I also assume that you have a general idea of how to manage your money—let’s build off that.

For starters, we want to earn more money than we spend.

Obvious? I guess for a lot of us no:

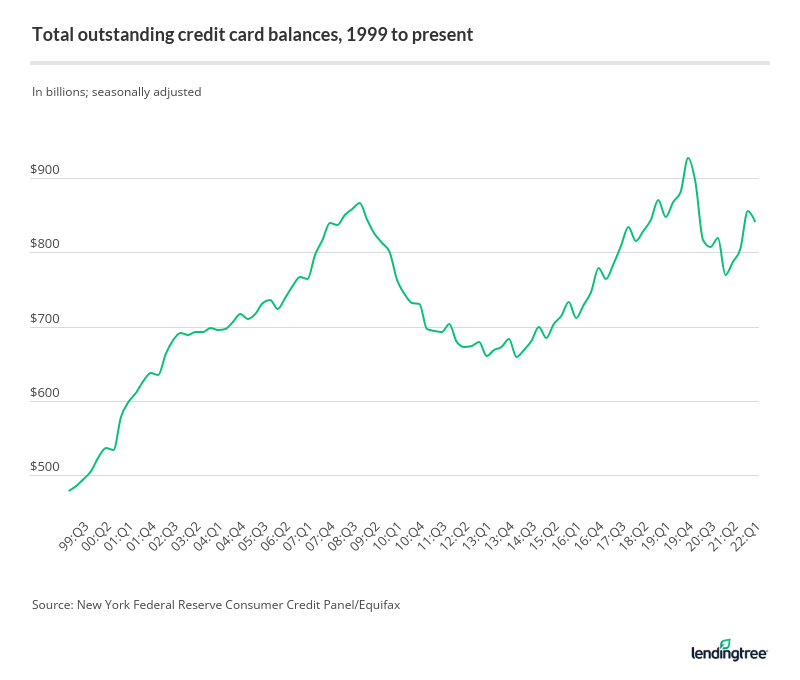

You don’t have to be a data wonk to behold Jacob’s laddah ovah’ here.

You don’t have to be a data wonk to behold Jacob’s laddah ovah’ here.

This graph depicts an alarming phenomenon—that Americans from coast to coast are saddling up the debt.

Let’s say I rake in a net income of 2 grand a month. After the bills are paid I’m left with 300 bucks—not bad.

The thing is, there’s this espresso machine I saw online that’s got a chokehold on me. Not only does it look bougie as hell, but it grinds, doses, and extracts. And that bean hopper capacity—my goodness—I’ll be wired like a server rack!

I will literally lose it if I don’t hear me some dank roast dribbling by Monday morning.

The flip side is that it costs an exorbitant 800 dollars.

Well, I have just the rationale to justify a senseless purchase like this:

According to Experian, the average credit card balance is $5,525 per household.

According to Experian, the average credit card balance is $5,525 per household.

So what do I do? I cast my prudence aside and fold like a cheap suit. I even shell out a hefty outlay for rush delivery.

It’s ok—I still have 300 bucks in the bank.

So what happened?

Because I was preoccupied with fetishizing coffee beans, I YOLO’d a coffee machine with someone else’s money—bad move.

In one month, I spent more money than I made. That’s 300 bucks left minus 800 bucks. Simple math dictates I’m 500 bucks in the hole.

No problem—as long as I pay the minimum on the card each month I’m golden.

Not really.

By choosing to pay the minimum each billing cycle, I’ll have it paid off in two years plus something to the tune of 150 bucks in interest.

APR—annual percentage rate—is killer. For our sake, the acronym stands for A Problem Recurring; promptly commit that to memory.

Every time you make a credit card purchase, you’re using a bank’s funds to pay for something. Their incentive to offer you this money is collecting interest on the full amount they’ll be paid back.

We all know this—I hope.

But take a second to think how asinine this concept is: You’re being charged money to pay for something with someone else’s money. Your intuition should now be alerting you that something widely endorsed as legitimate reeks a little foul.

Why fatten a fat cat’s purse? Because you have no streak of delayed gratification?

That’s a fool’s game—a pauper’s game.

So why is this my point of departure?

Because aside from “good” debt which doesn’t apply here, debt—in all shapes and sizes—maneuvers like a masterful assassin; it is stealthy like fine print and insidious like a derogatory remark on your cherished credit report.

There is no greater malady to the overall health of your finances than toxic debt.

If you take anything away from this article, that should be it.

According to Experian, the average credit card balance is $5,525 per household!!

The Basics of Financial Planning

Financial planning just means managing the money you’re bringing home and yes, it involves a plan.

A plan doesn’t exist without an end game—there has to be goals.

Where there are goals, there also must be strategies to achieve those goals.

Absent a plan, you’re just haphazardly throwing your cash all over the shop; paying bills on the fly, spending blindly, and relying on mental math to confirm you’ll have rent money left over after a night out with pals.

Speaking plainly—that’s just stupid.

Preparing Your Financial Plan

The time-tested process of financial planning looks like this:

- Explicitly define financial goals

- Develop strategies to achieve said goals

- Execute those strategies

- Evaluate progress

- Revise as needed

It’s worth noting that this general process can be applied to just about any plan—financial or not—but as far as your finances are concerned, trust the process and don’t look back.

This is the way.

Defining Your Financial Goals

The first step in financial planning is to clearly state your goals.

Here are a few general examples of financial goals to help you contemplate your own:

- Pay off debt

- Build and emergency fund

- Purchase a home

- Reduce expenses by 15%

- Buy a car

- Save for a vacation

- Buy a new TV

- Find a better paying job

You absolutely must take into account your current financial situation when deciding your goals. If you’re asking yourself what goals make the most sense for you, read this post.

As you’re brainstorming, do what I do—take out a notebook and write them down. By writing them down, the ball starts to roll.

One of the hardest parts of doing anything is to overcome the inertia of actually doing it. At least jotting your goals offers little resistance, and you’ll find it easier to hit your stride as you progress.

Realistic or Just Pessimistic?

It’s important that your goals are realistic.

Again, being realistic about your goals just means taking stock of your current financial situation and planning feasible outcomes within a specified time frame.

Real quick—if I’m netting 50k a year, driving a Lambo fresh off the lot by the year’s end would not be a realistic goal. You get it—I know—but what if I really did want a supercar?

Well, I’m not in the business of discouraging any financial goals because they’re too lofty, ambitious, or what some would call extravagant.

The Prosper Mentality dictates that anything in life is possible, but what I am saying is that for now, before you’re all comfortably nestled in the lap of luxury, start planning realistically to lay the groundwork for more aspiring goals in the near future.

Good Things Take Time

A well-rounded financial plan consists of short-term, intermediate-term, and long-term goals.

- Short-term—one year or less (e.g., buying: furniture, TV, appliances)

- Intermediate-term—one through five years (e.g., pay off a loan)

- Long-term—five plus years (e.g., retire)

You’ll find that upon completing your financial plan, the timing of several of your goals will fall into either of these three buckets.

Tacking on a date to your financial goals is essential.

Having a concrete date hold us accountable and ensures that we’re on track with our goals.

Develop Strategies

The word strategy has an interesting etymology. It derives from the Greek word, ‘strategos’, meaning general or commander of an army.

For the most part, a general’s not worried about being carted off the front lines in the meat wagon. The General, and the other top brass are too busy hunched over a dimly lit map sliding pieces around like seasoned croupiers.

A general without a plan will never triumph in wartime.

The general is the master architect. When building your financial plan, you are also the general—the master architect of your money.

The General’s Map

Imagine that you are now dubbed, “General Wherewithal”.

Opposite you lies a tabletop map demarcated by four different territories: spending, saving, investing, retirement, and insurance.

A humble pile of glimmering, brass dollar sign tokens rests on the far corner of the map atop home base—Fort Income—awaiting to be dispatched.

You—General Wherewithal—must now contemplate where to move each individual token.

What do you do?

Your primary zones of movement consist of the following:

- Spending—where your money is going (needs & wants; bills & surround sound systems)

- Saving—stashing the extra dough (rainy day funds and anything else you’re saving towards)

- Investing—where you intend to park your cash to reap the most gains (stocks, crypto, real estate, etc.)

- Retirement—your nest egg

- Insurance—protecting your assets. (home, car, etc.)

Here’s one thing any high-ranking general of Personal Finance knows:

Money earned should constantly be in motion; and not just into the hands of lenders and e-commerce giants.

If you leave your shiny little brass tokens at home base too long, they’ll get tired and rusty—the rest of us recognize this phenomenon as inflation.

You need to send them on a mission to go out and round up more brass tokens for you—these are what are called returns.

Obviously you can’t send them all out chasing returns; then the bills won’t be paid.

Neither should you exhaust your checking account balance in between pay periods for the sake of prodigal pursuits—leave that up to General Spendthrift who’s preordained to suffer a humiliating defeat.

This is why a good general knows that having a solid plan is imperative in achieving success.

A large part of your financial plan is nothing more than deciding how you spend your money and where to move the rest.

Execute Strategies

When I was a kid I was obsessed with wrestling.

One of my favorite wrestlers of all time was Bret “The Hitman” Hart—to this day, still one of my heroes.

Who can forget this theme song:

Because of his masterful skill and technical aptitude in the ring, he acquired the nickname, “The Excellence of Execution”.

Thanks to this legend—I apply this to everything I do. 💪

Execution—or action—is one thing, but excellence in execution means that anything worth doing should be done to the best of your ability.

There is no room for half-assing it.

Like a madman, you must hone your craft over and over and over again until it’s so embedded in your psyche that you’ve now elevated to supreme status.

There will be actions required of you that demand repetition in order to achieve your goals.

Programmed repetition is impossible without self-discipline.

Remember this quality and worship it like a new godhead.

When it comes to putting your financial plan into action, this is hands down the most important mental quality.

Self-discipline means nothing more than pushing yourself to do things even when you don’t feel like it; it involves sheer willpower and determination.

Don’t get me wrong, I’m not trying to say that sticking to a financial plan is super hard or anything—it’s not—but you’ll find that just like anything else you want to accomplish, self-discipline must be nurtured.

When I find it hard to get the ball rolling, I like to repeat my favorite mantra: motion before emotion.

This simple phrase more than suffices to answer the question:

“What do I need to do to develop self-discipline?”

When motion lags behind emotion, all your actions are predisposed to your current mental state, thereby fashioning your emotions into a fickle conductor of agency.

When emotion precedes motion—action—no longer are your actions bound by fleeting temperaments; you are free to act as you know you must act.

Nike’s slogan nails it with, “Just Do It”—if this isn’t the best slogan of all time I don’t know what is.

In Greek mythology, Nike was a goddess who embodied victory in all things. 🏆

Nike knows that self discipline is the fundamental quality required in order to achieve victory—in order to win.

Budgeting your money, for example, is just one of many aspects of financial planning that requires self-discipline. If you’ve never tried budgeting your money before, you’ll soon learn why.

I wasn’t a fan when I first started, but I’ve learned to enjoy it with time.

Self-discipline has more value to you than motivation or inspiration.

Why?

Because motivation and inspiration are fair-weather friends; they only stick around when times are good.

Self-discipline on the other hand rides with you through thick and thin.

Always look to self-discipline first as your impetus to action—your financial progress depends on it.

Evaluate Progress

Now that you have your financial plan in motion yo absolutely must keep tabs on your progress.

Are you on track to reach your goals with the time specified?

This means nothing more than an unflinching eye towards your budget and some simple number crunching.

Revise As Needed

Apparently this quote is attributed to Earnest Hemingway, although I’m not quite sure he actually said this.

Doesn’t matter though—it’s a boss quote.

Of course I’m not encouraging that anyone plan their finances while intoxicated, but what I am saying is that you shouldn’t spend too much time over analyzing every single detail to the point of stasis.

I like this quote because you can loosely apply it to just about anything.

I like to think it can imply doing something—anything—with a basic understanding, then refining it as you move along.

Many aspects of your financial plan will require tweaking as you progress.

TL;DR

My first lesson in personal financial planning: beware of needless debt.

Debt is the ultimate wealth killer.

A financial plan first requires clear goals; this is key.

The Financial Planning Process looks like this:

- Define Goals

- Develop Strategies

- Execute Strategies

- Evaluate

- Revise

You must follow each one in order to be the most effective.

Peter David:

- PeFi blogger

- got that moolah medulla 🤑

- hates bills

CHECK OUT MORE

EARN

SAVE

INVEST

PROSPER

THE PAUPER’S GAZETTE

SHARE THE WEALTH

Nice To Meet You

Hi, I’m Peter David —

wealth management guru, self-proclaimed hermit, book nerd, perpetual thinker 🤔

“Always borrow money from a pessimist—they don’t expect to get paid back.”

Table of Contents

IN THIS ARTICLE

Pauper's Gazette

“How can I stay updated?”

Subscribe to stay updated on latest posts and $ saving “hacks”!

* click the newspaper icon on the menu for more details

Share

If you made it this far, maybe someone else will too 👍