Success, The American Dream, and the Pauper's Path to Prosperity

What does success mean to you? 🤔

Like anything else, success is relative; depending on who you are, your values, and your goals, success can mean just about anything.

For some, success can mean being able to provide for yourselves and family, or maybe being an excellent role model to your community.

For others, success can mean living in a penthouse in L.A., weighty Cuban links draped over your torso, VVS adorned digits and foreign whips—ballin!

Life is amazing because you’re afforded the time to lounge about and flex your lavish lifestyle.

Ahh, how the seduction of the good life beckons..

But for the sake of realistic expectations, let’s pull ourselves out of the gamma quadrant for a second. The point is—the sky’s the limit for defining success.

For many of us, the word success has clear financial overtones. Success means generating enough income to support the lifestyle we want. Speaking candidly, success means mo’ money baby—without the problems.

If that definition of success strikes a chord with you, read on.

The Fading American Dream

For a long time, being successful in America meant embodying the American Dream. The American Dream has always been somewhat of a mythical ideal, but it basically means:

You’re born poor > You work hard > You get rich

In theory, this would apply to anybody living under the auspices of the great U.S. of A—the dream don’t discriminate!

The American Dream is still within reach today, but with one crucial distinction—today, more is required of us to get rich than just working hard.

If it was hard then, it’s WAY harder now.

Like it or not, we have to accept that the conventional notion of working hard is not enough, that moving up is three times as hard as it used to be, that having a decent paying job, providing for a family, and owning a home with a nice picket fence seems beyond the horizon for many of us.

In fact, the only picket fence some of us will ever encounter is one wrapped in razor wire standing between us and our modest aspirations.

If that immediately comes off as a ridiculous notion to you, be thankful that you’ve been afforded the life which allowed that sort of knee-jerk reaction.

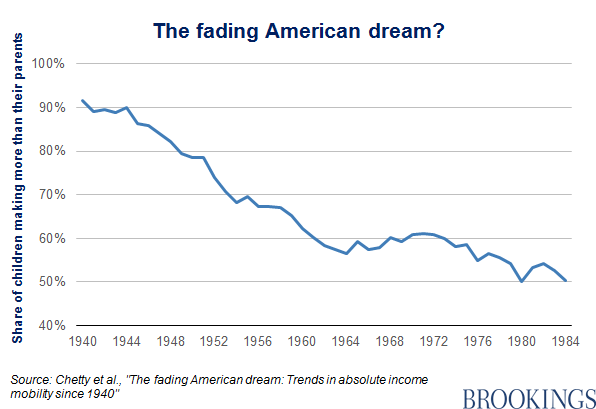

With that said, social mobility is the core element that defines the dream. Social mobility means movin’ on up plain and simple. Being born into poverty and making more than your parents did, demonstrates social mobility in practice and using “making more money than your parents did” as a rough yardstick for the fitness of the American Dream, we can clearly see how that’s trended over time:

Let me be the first to tell you: there’s no buck in the trend lately.

For Millennials and Gen-Z, the likelihood of that dream is arguably more remote now than it was for past generations and will be reduced to a mere utopian ideal for generations to come if we don’t swerve ASAP.

Just staying afloat is hard enough, much less moving up, and we’ll go to great lengths to do it, even if it means racking up crippling amounts of debt.

With this being the new normal, keeping up with the Joneses is equivalent to financial hara-kiri, where saving face means burning your financial house to the ground.

There are tons of reasons why the prospects of this lofty American ideal have dwindled dramatically since the days of Ben Franklin and his quill scribbling posse, but I’d be going off on a tangent if I discussed them all here.

SO..

Before you can call that upscale country club your usual haunt, where you’re busy hobnobbing with the other bon vivants, you’ll have to seriously think about how you’ll make it there.

So, without further ado, you may be asking yourself:

How Can I Start Ballin’ Like the Big Wigs?

*twirls mustache*

You need to learn how to play the game.

Unless you’re living off the grid and have dropped out of society completely, you’re subject to the rules of the game known as the free market capitalist system..

🥱

Whether you agree with the game or not doesn’t matter. Earning and building your wealth within the bounds of this game is all we care about.

I’ll get back to this, but let’s shift our focus for a bit.

We’ve all pondered the answer to this question:

“What would I do if I won the lotto and hit the big jackpot?”

Hmm.

Typical answers would include a big house, nice cars, traveling the world, compin’ the fam, yadda, yadda, yadda.

But let’s briefly descend from the stratosphere and ask ourselves this instead:

“What would I do if I knew how to get rich?”—instead of relying on near-impossible odds.

The obvious answer to that is that we’d probably do it, right?

Wrong.

The truth is, most of us vaguely know the answer to this question, but don’t know how to sort through the patchwork of things we already know, the bad advice we’ve heard in the past, and the myths we’ve been told our entire lives about making money.

We’re left mystified as to how to put all the pieces together and become complacent at our current lot in life.

There is, however, a tried and true path to wealth and success.

- What exactly is this path?

- What’s the secret?

- What does the 1% know that I don’t know?

I don’t want anybody to be duped by this one.

There’s absolutely no secret, and I caution all of you to steer clear of Get Rich Quick/Secrets to money making schemes— it’s completely bogus, and I’m very passionate about this point.

Check this out:

Embedded deeply in the uncharted parts of the jungle, there lies a tightly sealed coffer somewhere in a mysterious cavern.

Within this coffer lies an arcane scroll, unperturbed for centuries.

The exact location of this coffer is a carefully guarded secret known only to a cabal of ancient origins.

It is only they, who by reciting the scriptures within the scroll, invoke the deities of the well-heeled who make it rain obscene amounts of cash that fall from the sky like mana unto their anointed ones.

In my course, I’ll reveal the EXACT coordinates to this cavern, teach you how to network and get exclusive membership to this cabal, and finally give you all the tools you need to decipher the contents within the scroll.

Your eyes will roll to the back of your head once you realize the orgasmic amounts of money you’ll be making.

This is my FIRST TIME EVER doing this, but within the next 48 hours, I’ll be offering this course for $200.00. That’s a $10,000 value!!!

So please, PLEASE, I beg of you, I’d HATE to see you miss out on this opportunity of a lifetime.

Sign-up for my course today.

As an additional BONUS, I’ll give you all the tools you need to pry open that coffer too…

You get the picture.

Unless you’re the most gullible person in the world, there’s no way in hell you should believe that story.

So, from here on out, I want you to make strong mental associations with this story and any get rich quick bullshit where in just a few days, you could be making thousands per month.

They are BOGUS!

If getting rich was quick and easy we’d all be rich.

I get it though—sometimes our lust for money can cloud our good judgement.

I’ve also encountered types that feel there are mysterious ways to wealth that are strictly reserved for the stereotypical financially savvy Wall Street types with neatly parted hair and glossy dress shoes.

That somehow, they’re the only one’s privy to “the know”.

That is absolutely and categorically:

If there are “secrets” to getting rich, they certainly don’t fall within legal bounds, and PP doesn’t condone or support any kind of illegitimate ways of making money—that’s what the dark web is for people!

And if you go the route of ill-gotten gains, be prepared to spend some time in the clink with your cellmate Bubba—or Rhonda—for a long, long time.

Hard times doin’ hard times I say.

So, let me clue you in:

The truth is that all the information to build your wealth is out there, it’s readily available, and it’s absolutely free.

Take a moment to show some gratitude for the ease at which we have access to all sorts of knowledge. It feels awesome living in the information age, right?

So, let’s get this “secret” out of the way.

Unless you’re one of the lucky ones who have:

- Won the lottery

- Been born into wealth

- Been endowed with a hefty inheritance

You’ve made a considerable amount of money because:

- You’re an entrepreneur who’s become wealthy through your own blood sweat and tears and is reaping the fruits of your enterprise

- Your career happens to be on the list of highest-paying jobs (think anesthesiologist)

- You’ve had a successful career and consistently increased your earnings by moving up into the higher rungs of corporate management (which comes with sweet $ makin’ perks)

It’s evident these examples illustrate that working hard will get you somewhere, but does this disprove the argument that it’s harder to achieve the American Dream today?

No, because keep in mind that most people that makeup categories 2 and 3 have a leg-up by virtue of a college degree. There are outliers in this category, but they aren’t the rule.

In the spirit of equality, a system that favors the highly educated is nothing short of elitist, and some might argue a meritocracy—👎

Not all of us choose to or can pursue a college education for a wide variety of reasons, be it personal, economical, or systemic.

Those comprising the categories above have sizable clout in the game, and needless to say, have worked hard in their own right, but it stands to reason that socioeconomic advantages have benefited a good percentage of them by helping to carve out that path.

With that said, is there anything else that applies more generally to everyone?

There sure is.

Whether you fall into one of the categories above or not, the real “secret” to building wealth is:

Learning how to earn more money, be disciplined enough to save that money, and wise enough to invest it.

There’s nothing really sexy about it.

These are the bare-bones fundamentals. It sounds simple on paper, but as much as some of you may not like hearing this, it requires continuous effort.

Do you think you have what it takes? Because if you thought this was a stroll down easy street you might as well start signing up for that pathetic course example above—I accept Paypal and Cash App btw 😂

But seriously.

Allow me to briefly go over each point.

The Pauper’s Path

Earning Money

Let’s start at the low end of the national minimum wage: $7.25 per hour 😱

That hourly wage would gross you about 15k annually.

We’ll be conservative and say the higher end of the scale is roughly 200k per year, for those I refer to as the “six-fig bigs”—six-figure big shots (e.g., doctors, lawyers, bankers, you get it).

Working full time, it’s safe to say that your annual earnings are somewhere in between the range of 15k-200k.

You’re either bringing home the bacon bits, the bacon strips, or the entire pig.

Allow me to go over a few points while I work with that delicious range of income.

If you’re the Bacon Bits:

You’re probably just barely getting by and living from hand to mouth. It’s safe to say that you either don’t have a college degree, or you do have a college degree, but it’s of little value in the labor market. You probably haven’t tapped into your skills and are currently underselling yourself.

Your extra time should NOT be heavily invested in side-hustles to make more money unless you absolutely need the extra money or are saving that money to invest in yourself.

Ideally, you want to be able to use any of your spare time to enhance your skill set. Arguably, the experience you gain from filling out surveys or becoming a dog walker is of little to no value in the job market and you’ll find it very hard to move up.

As far as wealth creation goes, side hustles are not an end in themselves and are a means of getting out of a pinch or helping to pay to invest in yourself.

In future posts, I’ll show you the path to take to acquire a greater skill set and rouse your latent talents.

If you’re the Bacon Strips:

If you’re bringing the bacon strips home, you either have a desirable skill set or a valuable college degree, or both. Granted that you’re not trapped in debt, you’re in a good spot. You probably have room to grow within your career and also make more money on the side to pay down debt or invest.

As it stands, could you be underselling yourself? Are you low-balling your value to your employer?

These are just a few super important questions you need to ask yourself in your quest to unlock your earning potential.

Small moves can and will make a big difference.

If you’re the Pig:

Consider that a compliment, you can be somebody’s rich aunt or uncle and their personal piggy bank one day—thou shall be dubbed Daddy/Mommy Warbucks.

Most of your energy should be focused on paying down debt, investing, and retiring.

Be careful not to let lifestyle inflation creep up on your net worth or soon you’ll be part of the AFNC club—all flash no cash.

No matter where you fall in income level, there is always the potential to earn more. If you’re at the lower end of earnings, fear not, because that only means that you have way more room to move higher. If you’re already at the top—great—that means you have more room to invest your money.

Always remember that no matter what income level you’re at, if you have the grit, the determination, and the risk tolerance, you can always consider being your own boss, starting your own business and becoming an entrepreneur.

This path is not for the faint of heart, but if you have the time and cojones, go for it.

Saving

Saving lets you accomplish two things—prepping for an emergency and reaching your short-term and intermediate-term financial goals. Long-term goals should be invested carefully.

To save effectively you need to:

- Live below your means

- Budget and track your spending

- Pay off toxic debt

- Choose the right savings account

Living Below Your Means

Spending less than you earn defines living below your means. It’s all about sustaining positive cash flow. Just hearing the term, “positive cash flow,” makes my brain crackle and pop with dopamine. I’ll show you how to live below your means while still enjoying your life to its fullest.

Budget and Track Your Spending

Budgeting—simple in theory—difficult in practice.

Anyone that’s tried budgeting KNOWS this. Even the word “budget” has become a pejorative of sorts. The last time I mentioned budgeting to someone, their eyes glazed over immediately.

As boring and tedious as budgeting is, it’s indispensable in any financial plan.

The miscellany of budgeting tools available out there will make this a cake-walk though I promise.

I’ll cover those in other posts.

Pay Off Debt

If debt impedes wealth building, then toxic-debt is its absolute kryptonite.

I’ll show you how to put on a clinic when it comes to paying down debt.

It doesn’t matter if you have loans in default or if you’ve been paying your dues on time. I’ll show you how to deal with each scenario as I’ve been through all of them.

Choose the Right Savings Account

Choosing the right savings account is more than just parking your money in accounts offering the highest interest. Chasing interest rates that are marginally higher than others is a royal waste of time.

I’ll discuss savings accounts at great length in future posts.

When it comes to saving money, every dollar should serve a purpose.

If you already have money in your savings that’s a BIG plus; you’re already ahead of the game. But if you don’t know what that money is doing—you, good sir, are all hat and no cowboy.

Every dollar has a plan: this dollar is for a down payment, this dollar is for a rainy day, and this dollar will find its soulmate and be two in a couple years.

Dolla dolla bill y’all—it’s what makes the world turn.

I’ll teach you how to save and plan for your financial goals.

Investing

Saving is vital, but if you think that’s the fastest way to grow your wealth, well, you’ve just bet on the wrong horse.

Enter investing.

Investing money may not sound like the sexiest thing in the world, but believe me, it starts to look sexier once you start doing it and time moves on. Investing is like Benjamin Button basically—first name not a coincidence.

Just think, making money while you sleep. Yes, that’s a thing. And it’s easier than pronouncing the word investing backwards. Seriously.

You just tried pronouncing it backwards amirite?

One myth I want to quash early on is that you don’t have to be rich to invest: anyone, regardless of wealth or status can do it.

Sure, there are some caveats to know before investing and I’ll cover this, but for now, just know that you don’t have to be special.

Finally, those of us with deep pockets all know that..

It Takes $ to Make $

No matter what degree of your financial aspirations, don’t forget this one. It’s the oldest and most important rule of them all. You need to put your money to work—you need some skin in the game.

If you learn to plant a few shekels the right way, pretty soon you’ll have your own money-tree sprouting dollars while you’re out there living your best life.

Too good to be true? Not at all.

It just takes time, effort, and persistent cultivation. This is decisive.

Contrarians to this rule are out there, but I’m generally averse to against the grain financial advice, and you should be too.

Remember:

If the road to hell is paved with good intentions then—

“The road to riches is paved by tried and true methods”

I want that indelibly etched into your mental archives.

Remember that pithy saying of mine because it’s fundamental to your financial quest, where bad advice can leave you down and out, and you’ll have to do a hard reset as the words, “GAME OVER”, bounce back and forth in your head.

I’ll cover all the best investing practices here, whether you’re a beginner or already a pro, you’ll find my content very valuable.

Sincerity before Prosperity

It doesn’t matter who you are or what your circumstances are, if you want to reach the pinnacle of your financial success, I’ll point you in the right direction.

But I’d be insincere if I didn’t mention something crucial: You Must Put In the Work 💪

If you’re willing to put in the work, I have no doubt that you’ll get there soon enough.

You don’t need to be a financial guru either: all the methods at PP are practical, widely used, and articulated in great length.

I avoid delving into technicalities and financial jargon (i.e. currency swap basis, interest rate swaps, etc.) because let’s get real, we don’t care about that and it’s boring as hell. We’ll let the financial nerds at Investopedia expound on that mumbo-jumbo.

This is a nod to the incredible resource which is Investopedia btw, NOT throwing shade

But seriously, we don’t need to understand the physics of how a spark plug works in our car to drive us from point A to B. By that same token, we don’t need to get crazy with financial theory to make money either.

The road to prosperity requires smartening up with your finances, changing your mentality, and choosing the right path.

Learning the game means earning, saving, and investing—the right way.

You can’t earn more, save more, and invest more without first demanding a little more from yourself too. Don’t make the road harder experimenting blindly with your money and 🙏for the best outcome.

Important Words

No matter what your current situation is in life, never be upset about where you are, and stop comparing yourself to others.

I learned to stop doing this a while back and am still guilty of that from time to time, but I have found that the less I do it, the happier I am.

Don’t be bummed out if you feel like you’re struggling to keep up with the pack. You have the power to change this.

Life has offered everyone their own unique lessons. Take those lessons with you and keep moving forward. All the hardships, all the struggles, wear them like a prize as they’ve made you who you are today.

Keep fighting! Keep hustlin’! Keep going! Do it!

We can’t change the cards we’re dealt in life, but I’ll show you how to play your cards effectively to maximize your potential towards your financial end game.

Among the many obstacles that present themselves along the way, I want you to think of PP as the X-factor in achieving the desired outcome.

I created Prosper Pauper to serve as a beacon throughout your financial journey—I hope you find it will do just that.

Peter David:

- PeFi blogger

- got that moolah medulla 🤑

- hates bills

CHECK OUT MORE

EARN

SAVE

INVEST

PROSPER

THE PAUPER’S GAZETTE

SHARE THE WEALTH

Peter David

“If you think nobody cares you’re alive–try missing a couple of payments.”

Hi, I’m Peter David: p-Fi bloggah, book nerd, cat owner, #boston, love 🍕

Table of Contents

IN THIS ARTICLE

Pauper's Gazette

“How can I stay updated?”

Subscribe to stay updated on latest posts and $ saving “hacks”!

* click the newspaper icon on the menu for more details

Share

If you made it this far, maybe someone else will too 😊

Great post Peter! 😂